About Accountants Firms

Wiki Article

A Biased View of Accountants Book

Table of ContentsThe 8-Minute Rule for Accountants ResponsibilitiesRumored Buzz on Accountants FirmsGet This Report on Accountants Journal7 Simple Techniques For Accountants JournalRumored Buzz on Accountants Journal

Depending upon the market you remain in, the bulk of the year will be your "busy season." Some sectors this might not apply and also you'll just be called for to function the typical 40-hour job week. Typically, team accountants require a little bit of an education and learning to find a job. And no, we're not chatting regarding a secondary school degree.

In order to come to be a CPA, you require to have a BA in Accounting, Money, Organization Management, or an associated area (accountants and auditors). As implied in the name, you require to obtain a certification to fill the function, and this is usually come before by years of experience in the field as a public accounting professional.

Accountants And Auditors - Questions

Average Income: $60,528 Degree: Bachelor's Level, Sight Even More Mouse over a state to see the number of energetic accounting professional tasks in each state. The darker locations on the map show where accounting professionals make the highest wages across all 50 states. Average Wage: Task Openings:.A bookkeeper's job is to maintain complete records of all cash that has actually come right into and also gone out of the organization. Their records allow accountants to do their jobs.

As soon as you understand what tasks you require the accountant to do, estimate for how long it will require to finish those tasks. Based upon that computation, make a decision if you require to hire someone full-time, part-time or on a task basis. If you have complicated books or are generating a great deal of sales, hire a qualified or accredited bookkeeper.

How should we tape-record these transactions? Once the accounting professional decides just how to deal with these transactions, the accountant brings them out." The accountancy process generates records that bring essential elements of your service's finances with each other to provide you a complete photo of where your finances stand, what they suggest, what you can and also ought to do regarding them, as well as where you can anticipate to take your service in the close to future.

The Of Accountants And Auditors

To complete the program, accounting professionals should have four years of pertinent work experience. CFAs should also pass a tough three-part examination that had a pass rate of only 39% in September 2021. The factor here is that employing a CFA indicates bringing highly advanced accountancy expertise to your business. A CIA is an accountant that has actually been accredited in performing interior audits.Their years of experience, your state and the complexity of your accounting needs influence the cost. Accounting professionals will certainly either quote a customer a repaired rate for a particular solution or charge a general hourly rate.

It can be tough to determine the suitable time to work with an accountancy professional or bookkeeper or to establish if you need one in any way. While many small companies work with an accounting professional as a specialist, you have numerous alternatives for managing monetary jobs. Some tiny organization proprietors do their own accounting on software their accounting professional suggests or utilizes, providing it to the accounting professional on a weekly, month-to-month Read Full Article or quarterly basis for action.

It may take some history research study to locate a suitable accountant because, unlike accounting professionals, they are not required to hold a specialist certification. Right here are 3 instances that show it's time to hire a monetary professional: If your taxes have actually come to be too complicated to manage on your very own, with multiple revenue streams, foreign investments, several deductions or various other considerations, it's time to hire an accounting professional - accountants and auditors.

Some Known Questions About Accountants Firms.

You might begin by contracting with an accountant that stabilizes the books when a month and a CPA that manages your taxes. As your bookkeeping needs boost, bring a person on personnel. Whether you work with an accountant, a bookkeeper, or both, ensure they're certified by asking for customer references, looking for qualifications, or performing screening tests.There are numerous paths to becoming an accountant. You ought to check out these paths to ending up being an accountant to locate out which is the appropriate one for you.

Newly trained accountants can earn 17,000 - 25,000 Educated accounting professionals with some experience can make 29,000 - 55,000 Elderly or chartered accountants can make 60,000 - 80,000. * Hours and also wage depend upon location, employer as well as any kind of overtime you may do. Wages and job alternatives enhance with chartered status. * Wages have been accumulated from numerous sector sources Check out the latest accountant vacancies: As these are external web sites, the number of openings connected to your recommended function may differ.

You may begin as a trainee or accounts assistant and also function your method approximately a junior or aide accounting professional whilst you are part qualified. When you are a totally qualified accounting professional, you might become an elderly accountant or operate in monitoring and also basics make a greater wage. Eventually, you can become a finance supervisor.

Unknown Facts About Accountants And Auditors

You'll require to have 3 years' job experience in a pertinent role to register. As an accounting professional, you could work in the public or private sector.Something failed. Wait a moment as well as attempt once again Attempt once more.

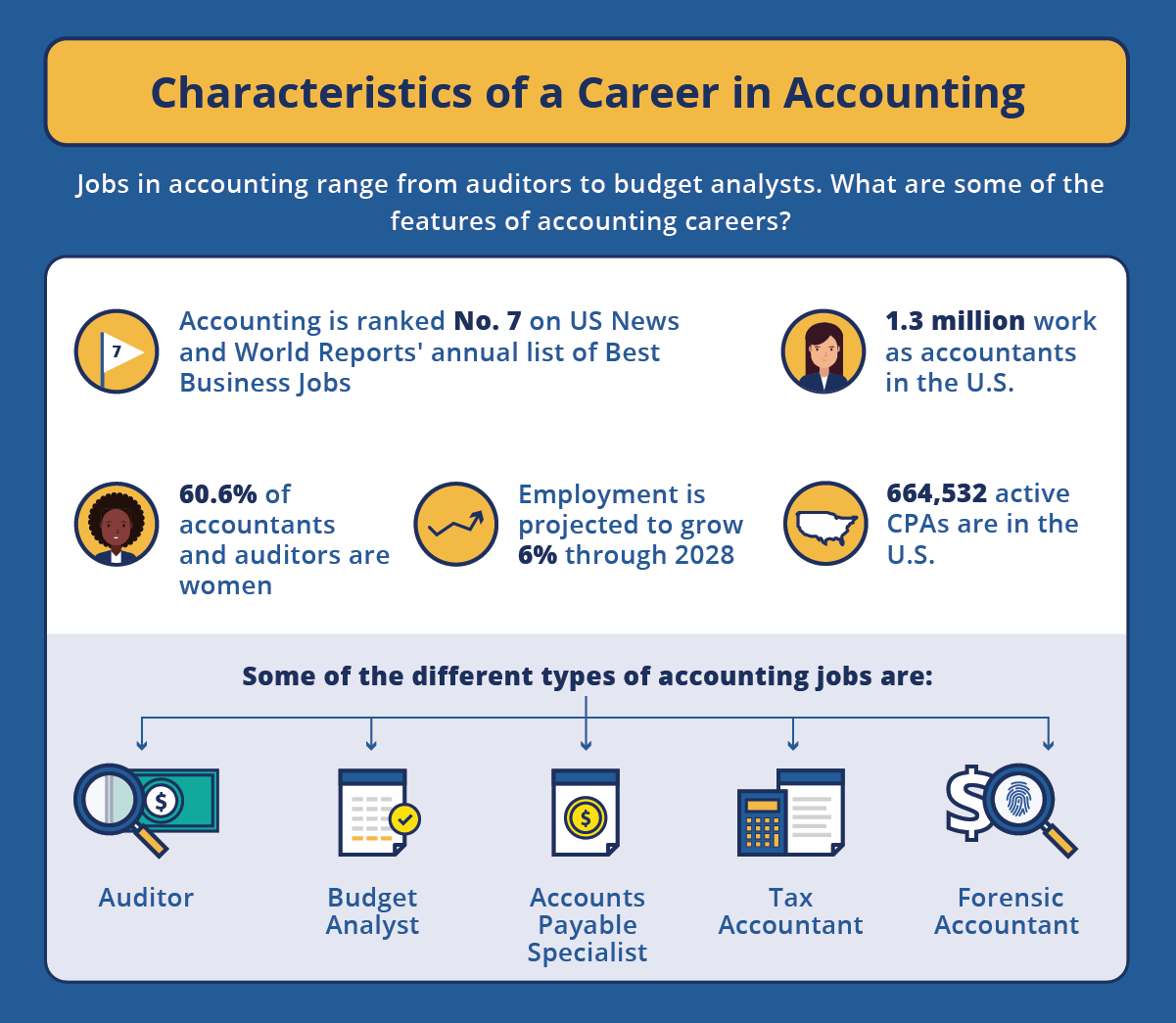

This above-average development rate may cause great leads for entry-level placements. The need for accountants is greatly driven by globalization as well as the increasingly intricate regulatory atmosphere in which we all now live. Modern technology is the one threat coming up. As regular Look At This jobs become automated, accounting professionals will certainly be anticipated to relocate away from basic accounting as well as instead handle a much more calculated as well as advisory function for their clients.

Based upon these findings, an accounting professional can then assist an organization or private create a monetary goal as well as strategy exactly how to achieve that goal (accountants and auditors). Whether you're considering becoming an accounting professional or employing one, this write-up will certainly cover all the basics. We'll look at: Accounting isn't necessarily the most extravagant appearing work, but it is just one of the most indispensable ones.

Report this wiki page